Vietnam benefits from firms’ moving out of China

Vietnam, boasting complete infrastructure, abundant industrial property on offer and a line-up of inked free trade pacts, is an attractive destination for world’s leading corporations, who are shifting production out of China due to high costs, said real estate consulting company CBRE Vietnam.

|

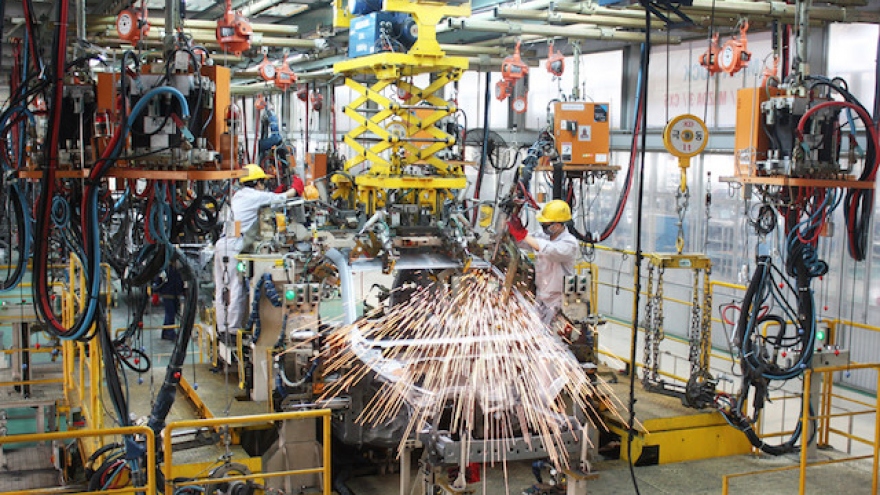

| A phone spare part production line of Samsung Electronics Vietnam (Photo: VNA) |

The company reported an increase in production shuffle from China to alternative locations in Southeast Asia, including Vietnam, last year, citing the results of a survey conducted in November 2018 by the UBS Lab which collected responses from 200 manufacturing companies with significant export business or supply to exporters from China.

The survey said key drivers for moving export production out of China include lower labour cost, lower land cost, less trade barriers, easier access to supply chain, better infrastructure and more industrial policy support, among others.

According to CBRE, Vietnam may be well placed to benefit from this production shifting as the Government continues to make heavy investment into infrastructure, and help producers get better access to key export markets by participating in many bilateral and multilateral trade agreements (FTA). Besides, the country’s sound economic fundamentals like GDP growth, foreign direct investment and inflation rate become key drivers to Vietnam’s competitive and land acquisition cost and labour cost.

CBRE experts said that industrial parks in the country achieved good occupancy rate of between 70 - 90 percent, and infrastructure connectivity played a major role in the occupiers’ location decision.

Meanwhile, Vietnam has signed many bilateral and multilateral free trade agreements, comprising five within ASEAN, six others between ASEAN and its partners including China, the Republic of Korea, Japan, India, Australia and New Zealand -, and four bilateral free trade deals. As the pacts allow removal of duties among membership countries, they will help foreign manufacturers setting up production in Vietnam to enjoy tax benefit when they export to those markets.

CBRE’s survey showed that the number of factories in Vietnam named in Apple supplier list increased from 16 in 2015 to 22 in 2018, all of which are FDI companies. Recently, GoerTek, an Apple supplier, decided to move its AirPods production base (wireless earphones) to Vietnam.

Following the same trend, Samsung Electronics Co., Ltd announced last year that it would cease operations its mobile phone production plant in China. Currently, 29 Vietnamese companies act as Samsung’s Tier-1 supplier. The localisation rate jumped from 34 percent of total product value in 2014 to 57 percent in 2017.

Senior Director and Head of the Research and Consulting Services for CBRE Vietnam Duong Thuy Dung said that as for the remainder of 2019 and the full 2020, there will be an increase in industrial property supply across Vietnam to benefit from this production shifting from China.