A prosperous year for Vietnam’s banking industry

Profits of many commercial banks this year will hit the highest levels since 2012 thanks to rising capital demand, experts have forecast.

|

Financial reports from banks showed that although two months still remain until the end of the year, many banks have already met profit targets set for the whole of 2017.

According to the Orient Commercial Bank (OCB), it completed its whole year profit plan within the first nine months, with pre-tax profit of VND789 billion (US$34.75 million) and completion rate of 101%.

As of September 30, 2017, OCB had total assets of VND70.87 trillion, accomplishing 83% of the year’s plan. Total mobilisation was nearly VND56.34 trillion, achieving 85% of the plan; outstanding loans were VND46.84 trillion, fulfilling 99% of the plan; and non-performing loan (NPL) ratio was controlled at less than 2%.

Tiên Phong Commercial Joint Stock Bank (TPBank) also announced its financial statement for the first three quarters of 2017, with nine-month accumulated pre-tax profit of VND807 billion, exceeding the whole year’s plan of VND780 billion.

As of September 30, 2017, TPBank’s total assets were VND114.5 trillion, up 28% year-on-year; outstanding loans were over VND67 trillion, equal to 97.8% of the year’s plan and growing nearly 20%; capital mobilisation improved nearly 21% from the beginning of the year, hitting nearly 95% of the year plan; and NPL ratio was less than 0.8%.

An Bình Bank (ABBank) also posted its business results and became the next bank to earn profit matching the whole year’s target in just nine months.

Specifically, in January-September 2017, ABBank attained pre-tax profit of VND429 billion, up 122% year-on-year, and completed 132% of the nine-month plan, equal to 95% of 2017’s target.

Prior to the above mentioned banks, the market also saw an unexpected profit increase for HCM City Development Bank (HDBank), which exceeded the whole year’s plan in just nine months.

LienVietPostBank came close to achieving its profit target for the whole year.

The announced business results made it clear that the year 2017 is unique as for the first time since the Government applied an economic stimulus package in 2009-12, Vietnamese commercial banks have witnessed such rapid progress in profit generation.

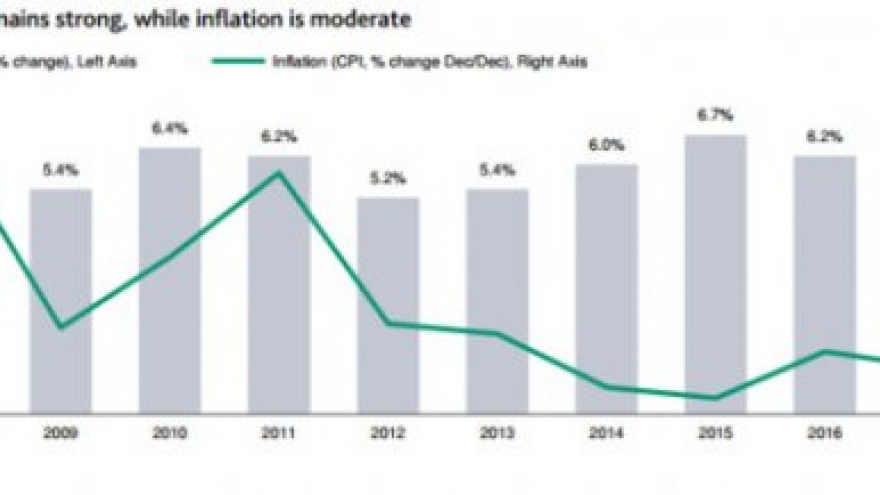

Experts attributed banks’ high profits to rising capital demand. According to statistics from the State Bank of Vietnam, credit growth in the first nine months of this year rose 11.02% against December last year. The increase was much higher than the rates of 10.78% and 10.46% in the same period in 2015 and 2016.