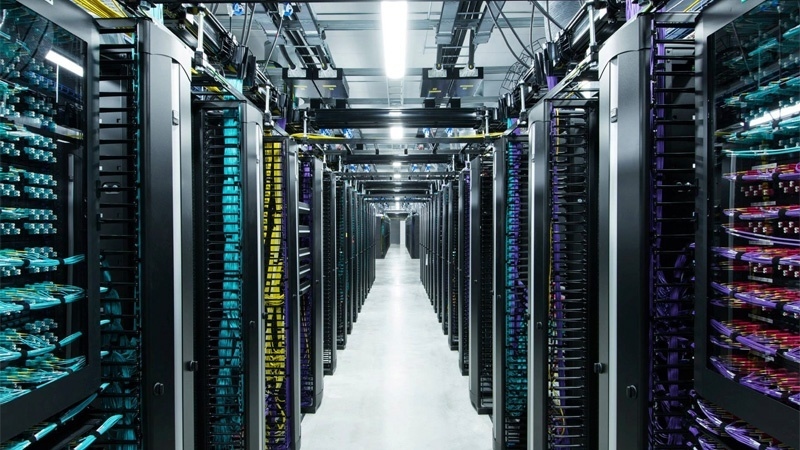

Data centre sector appealing to foreign investors

VOV.VN - The Vietnamese data centre market is capturing the attention of foreign investors due to high demand, according to JLL's comprehensive market report on the nation’s data centre sector.

The report recently released by JLL, said that the Vietnamese data centre market is currently dominated by local telecom players such as VNPT, Viettel IDC, FPT Telecom, and CMC Telecom, with remarkable growth recorded in cloud service demands and major data analytics.

However, international developers and operators are beginning to enter the market, including notable projects such as the 20MW facility by Gaw Capital in Saigon Hi-Tech Park, a 30MW project by Singapore-based Worldwide DC Solution, and a partnership between Japanese telecom giant NTT with DQ Tek, the report noted.

Most notably, Alibaba has revealed its plans to set up a data hub in the country, thereby highlighting a trend where more global cloud services providers, particularly from the United States, are expected to follow, thereby enhancing market competition and diversifying offerings.

Celina Chua, data centre client solutions director (APAC) at JLL, said, “Vietnam has recently climbed the priority list of countries investors and operators are looking to understand as they work out their market entry."

"This interest is driven by Vietnam’s strategic geographical location, dynamic economic policies, a young tech-savvy population, and the need for data localisation, positioning it as an important hub for data centres in Asia," Chua added.

"Our report illustrates the readiness of Vietnam to capitalise on these opportunities, with increasing support from the government and an ever-growing demand for digital services shaping a promising future for the sector here,” she said.

According to the JLL report, development costs for data centres in the nation typically span from US$6 million to US$13 million per megawatt, a range that reflects the bespoke agreements that characterise data hub construction and the variable local construction expenses.

This variance is also reflective of the broader Asia-Pacific region where countries like Japan, Singapore, and the Republic of Korea are experiencing escalating build costs, in contrast to China and India, which continue to present more cost-effective alternatives for data centre developments.

The Telecommunications Law 2023, which will come into force in January, 2025, is set to provide a more structured regulatory framework with clearer definitions and guidelines for data centre and cloud computing services such as telecommunications services.

This legislation, with a light-touch governance approach, is expected to provide a conducive regulatory framework specifically for the sector's development, potentially attracting greater foreign investment due to the liberalisation of market access conditions.

The Telecommunications Law 2023 allows 100% foreign investment in data centre services.

The nation’s recently ratified Power Development Plan VIII sets forth an aggressive strategy aimed at promoting the country’s total power generation capacity from approximately 80 GW to 155 GW by diversifying the energy mix away from coal toward more sustainable sources.

This transition can be viewed as critical for ensuring a reliable and stable energy supply which can meet the escalating demands of the rapidly growing, energy-intensive data centre sector locally, the report added.